Royal Canadian Mint Annual Report 2007 Highlights

From a Precious Metal Investment Perspective

Precious Metal Price Hikes In The First Three Months of 2008 Alone Threaten to Evaporate the Mint’s Entire 2007 Profit

This report is the result of a passing interest in the Royal Canadian Mint’s latest annual report (2007). I wanted to further validate whether silver sales for last year were up substantially and if so, why the Mint’s bullion revenues were not substantially higher. Those revenue numbers seem to check out, but in the process I uncovered a matter potentially far more serious: the doubling of both gold and silver debt obligations. Excerpts from the Annual Report are bulletted and in italics. The remainder is my commentary. I would like to thank silver analysts Ted Butler and Jason Hommel for taking the time to review this before I posted.

The Big Picture

The Royal Canadian Mint now derives almost half (45.3%) of its revenues from primarily gold and silver bullion and refinery production ($286,300,000 out of $632,100,000). Minting Canadian circulation coinage, the original purpose of the mint, is now down to 27.6% — slightly more than a quarter of its total annual revenue.

Bullion Bean Counting Appears On The Level

At first blush the bullion numbers weren’t adding up, so I delved further. In the end the numbers seem to fall within acceptable levels of tolerance. This reassured me, but the process revealed a more disturbing new policy which I detail further on.

So that’s an increase of 1 million ounces–remember this figure.

But the PM total shows an increase of only 400,000 ounces. So, if SLM production rose in 2007 by a million one-ounce maples all other precious metal production must have declined by 600,000 ounces.

Let’s assume for the moment that ‘relatively stable’ means ‘about the same’–although it does seem to imply a slight decrease it’s not clear and is probably not significant in terms of the 600,000-ounce deficit.

That’s a revenue increase of only $5.6 million. Now this is interesting. First the prices. Kitco put the average price of silver for 2007 at $13.38 and for 2006 at $11.54 — that’s an increase of $1.84 per silver ounce (or 15.9%). So if the mint only produced the same number of maples in 2007 that they did in 2006 (2.5 million) that would be an increase of $4.6 million–almost the entire increase in revenue for the Mint’s entire bullion business. But wait, they produce an additional one million maples. Assuming a spot price $13.38 plus the Mint’s mandatory $2 minting charge that’s an additional $15.38 million dollars. Adding the two means that silver revenues alone should have risen by $19,780,000 (let’s say $20 million).

So I guess the price of the other precious metals must have fallen last year. But wait. Kitco’s numbers show an average spot gold price of $603.46 in 2006 to $695.39 in 2007 — a difference of $91.93 per ounce (or 15.2%). Using the ‘relatively stable’ 2007 gold ounce production count of $278,616 then that should have translated into a revenue increase of $25,613,168.88 (let’s say $25 million).

Therefore, based on these numbers, silver and gold revenues for 2007 should have increased by around $45 million — not $5.6 million. Perhaps the platinum and palladium (of which the mint produces very little) fell off a cliff during this time? I’m afraid not. Kitco data shows an average spot rise in platinum from $1142.31 to 1303.05 (+14.1%) and palldium from $320.27 to $354.86 (+10.8%). Unless I’m missing something, the Mint seems to have misplaced about 40 million dollars in bullion revenue.

Towards the end of the report, however, under the Management Discussion section I find a clarification on the ‘relatively stable’ gold production count. Gold production actually declined from 296,097 in 2006 to 278,616 (a decrease of 17,481 ounces). If we go with the previously-ascribed Kitco spot gold yearly averages revenue for 2006 would be $178,682,695.62 and for 2007 would be $193,746,780.24. Therefore, in spite of the production decline, increased spot prices indicate the annual revenue for 2007 should still have risen by $15,064,084.62 (let’s say $15 million). We can reduce the missing revenue therefore to $30 million.

The Maple Leaf Coinage data at the back reveals a decline in palladium coinage from 2007 to 2006 of 53,292 ounces (68,707 to 15,415) which when using the greater 2007 price of 320.27 helps to correct the discrepancy by $18,911,199.12 (let’s say $19 million). This leaves an estimated $11 million still unaccounted for, but in light of almost $300 million in total precious metals $11 million (or about 3% of total revenues) is getting closer to being a tolerable discrepancy.

Management Appear Bullish On Precious Metals Future

It would make sense for Mint management to hold such a perspective–after all almost half of their business is now derived frum bullion sales and the product has been rising for seven years straight. Take note of this, however, since revelations further on appear to contradict this view.

Interesting logic: ‘volatile’ prices will ‘sustain’ demand. The beginning of this sentence doesn’t really make sense to me–unless I replace the word ‘volatile’ with the words ‘rapidly rising’–after which it makes a a lot of sense to me.

This statement is further validated by an Internet comment I read recently in a Jason Hommel Silver Stock Report communique, in which the author claims to have talked to David Madge, marketing director at the Mint. During the conversation Mr. Madge confirmed 2007 silver maple production was around 4 million ounces and that 2008 is on track to be around 12 million–a yearly increase of 200% if fulfilled!

Even though I am highlighting these bullish comments on silver it’s important to note how little prominence they play within the annual report overall. In fact, the accompanying press release and letters from Mint management make no mention of the word silver at all, but heavily highlight other (in my view) much less significant achievements.

Relevant Bullion Objectives

Later on in the report under 2007 Performance Details we read: “Overcame operating challenges in the silver refinery which allowed it to run at full capacity by October.” And even later on: “Start-up problems with the new silver refinery made it necessary to outsource a component of refining services in the first half of 2007. All difficulties were resolved and the refinery was running at full capacity by October.” Start-up problems with any factory are practically de-rigeur so this is not odd. What is implied, however, is that internal demand for silver coinage production was so great that had the Mint been able to produce more silver maples they would probably increased SLM sales by even more than 1 million ounces.

The last objective may be in reference to increasing difficulty the Mint may be having in acquiring additional silver.

This is another interesting number–I would like very much to see the Mint’s rationale for this statement. If true, this could be incredibly bullish for silver. It implies that an increase of only 1 million ounces on the world scene amounts to a 200% increase global market share. Either the statement is wrong, or the mints the world over are dramatically reducing silver production (which could be the case, but I doubt it). Under performance improvements the report states:

Because no numerical data is supplied it is hard to determine how significant this increase is. Its very mention in the report, however, may imply a growing difficulty for the mint in sourcing new silver supply to meet the growing investor demand.

And now the Whopper: Precious Metal Risk

Under Precious Metal Risk two items caught my eye:

At first it appeared to me that the Mint not is playing any games in the futures market…

… Except in the case of its relatively-small numismatic products (a rather stable $56.3 million, or 8.9% of total revenues) where they appear to be purchasing long contracts with the full intention of taking delivery (This is sadly now a rather foreign concept in today’s futures markets, especially in silver’s, let’s-short-the-market-by-half-a-year’s-global-production-indefinitely-and-be-damned-if-it-flagrantly-violates-every-free-market-principle-in-existance, futures exchanges in New York, Chicago and Tokyo.

But sadly I then found this third item under Commitments and Guarantees:

That’s a 2007 Kitco average spot price obligation of $154 million for gold (at $695.39) and $35 million for silver (at $13.38). Using the recent spot prices of $880 and $16.50 the Mint has so far lost over $40 million in gold and $8 million in silver (assuming they can cough up this gold and silver right now. So much for the $30 million of 2007 supposed ‘profit’ that the report so proudly trumpets.

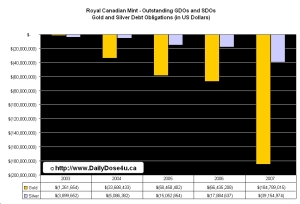

In 2006 outstanding gold and silver leases totalled 105,119 and 1,386,406 ounces — 2007 therefore represents an increase 111% and 91% respectively. Furthermore increased 2007 leasing activity appears to be a reversal in policy since in 2006 the Mint had been reducing their leasing obligations and stated in their 2006 Annual Report:

The Mint appears comfortable owing 2.6 million ounces of silver. The statement that:

… does not jive with the many statements throughout the report such as:

Why would the Mint not pay cash (the report goes on at some length about the amazing profits the Mint has made especially from foreign coinage production)? Two reasons come to mind:

1) In spite of all of their exhortations to the contrary, the Mint’s management really believes the price of silver and gold will decline and that leasing would therefore be proven a good call, or

2) They are unable to find sufficient bullion on the market (at least at prices the futures market seems to say must exist) and have decided that rather than limit future silver production (like the current rationing policies of the U.S. Mint) they will lease the metal instead.

I find the second reason far more credible.

This last item in the report for me is the most disappointing. As a Canadian citizen I am concerned that such imprudent borrowing policies could lead to large liabilities in the future for taxpayers.

Questions for the Mint

One final note: I would like very much to learn more about the Mint’s precious metal leasing activities. Specifically:

I just finished reading the CPM Silver Yearbook for 2008, and they list Canadian coinage fabrication demand at about 1 million oz. annually. Why then would the Canadian mint need to lease 2.6 million oz. of silver? Maybe the CPM Group’s numbers are off?

Regardless, it seems the height of foolishness for the mint to lease silver, and yes, they do seem to be speaking out of both sides of their mouth with regard to their silver positions.

Notably, this seems a lie: “The Mint is not exposed to price risk as a result of a change in price in the metals used for the bullion coins and wafers because the purchase and sale of metals used in these products are completed on the same date, using the same price in the same currency.”

This suggests that the mint is trading futures contracts daily. But a futures contract is for 5000 oz. at a time. Does this mean that the mint will only sell coins in lots of 5000 coins at a time? Clearly not. Therefore, they have risk to the upside and downside, on days that the numbers don’t match up exactly. Furthermore, they also have default risk if they don’t get the silver that they bought and paid for.

But here is the real problem. If the mint is buying a futures contract for delivery, to replace ounces sold, they would have a net long position, not a short position for 2.6 million oz. How could they be short if they are supposed to be long?

Perhaps they have borrowed the silver for their operating pool of silver, and they are losing money on that borrowed silver position, due to the time lag of minting operations.

Historically, has this ever happened before? If so, what were the results?

How differently do the US & Canadian mints work? Are they both dealing with similar (if not the same) demands for silver? If so, why would they be acting so differently? One rations, the other leases.

I am the individual that had the conversation with David Madge, The Mint’s Marketing Diretor in mid March. My call to him was prompted by the fact that my dealer in Vancouver (J&M Coin) had been able to confirm but one order with the Mint since november ’07, for 20,000 SML’s, and had been sold-out of Maples for over a month! Besides stating to me that he was VERY busy, that the Mint was on pace to sell 12M SML’s in ’08, and that 90% of production was sold outside the country, Mr Madge seemed quite aloof to the silver shortage. He stated to me that the market operates in cycles of six years, and that the recent high prices were part of a normal pattern (sub $5 silver was approximately 6 years ago). He was also surprised to hear that J&M was not accepting our order (I told him I was looking for 2000 SMLs), as they would surely have a hedge in place? I stated I thought that it might be hedging that had something to do with the fact that he was so very busy of late? He also down-played the volume that J&M does with his organization and that J&M didn’t actually meet the criteria required for dealer status. He told me Border Gold was their largest dealer in Canada and that SML’s were being shipped to Border the following week. I stated we didn’t buy from Border Gold and that one dealer in a town of 3 Million (Vancouver) was unfair. He then told me delays were due to capacity being allocated to Olympic coin production and that the cartidges for SML’s were in short supply? The Olympic excuse and the cartidge story were the same that I had heard a week earlier from Jon Nadler at Kitco. On a sidenote, I have since noticed one ounce Olymplic silver coins are selling in Canadian post offices for $79.95 and have a $25 denomination stamped on them. At one point I asked Madge if he were able to make me some SML’s if I shipped him a bar of my own? He chuckled. I also asked about 100oz bar availability (I have a few Cad Mint 100 oz bars). He said the Mint had not produced a 100oz bar since 1993. I asked what were their plans to increase capacity? He stated that their operation in Ottawa was small, there was no more real estate on Sussex on which to expand, and that good people were hard to find? Hah, he should put out a memo to the auto workers in Ontario perhaps. The discrepcanies in the Mints annual report detailed here jibe perectly with the tone of the conversation I had with Mr Madge. SJM

Jason:

It sounds to me as if the CPM folks are about two years behind the times: According to the 2006 Annual Report (page 45/47) and 2007 Annual Report (49/51) Silver Maple Leaf Production was as follows for the following years:

2005: 955,694

2006: 2,464,727

2007: 3,526,052

Company Annual Reports can be found on the Mint’s website going back as far as 2001.

( http://www.mint.ca/royalcanadianmintpublic/index.aspx?RequestedPath=/en-ca/theroyalcanadianmint/annualreport/default.htm )

“Olymplic silver coins are selling in Canadian post offices for $79.95”

That’s probably closer to what an ounce should be right now. Strap on your seatbelts, when this thing picks up steam we are going to go PARABOLIC. Every rock you look under there’s another silver conspiracy. And in fact, the conspiracy against silver is one of the oldest, dating back to the early 19th century. This cabal will not stop until every remaining ounce of deliverable silver is used up. Then the price of silver will hit triple digits, then it will surpass palladium, then it will surpass gold, then it will surpass platinum, then they still will have not found any substitutes for it…

The silver shell game is almost up. It may take another few months or years but a supply panic (like in rice or platinum) will eventually cause the 500% price increase in a short period of time. Patience!

Interesting article.

Yours Sincerely,

Adrian Burridge

CanadianInvestors.com

# What are the lessor names and amounts for all leasing agreements that the Mint is now obligated to repay?

Did neither Ted Butler nor Jason Hommel explain to you how this works? A third party stores precious metals with the Mint in advance of production requirements. Because the Mint guarantees these metals will be purchased at a specified future date, the third party is able to borrow funds to acquire the bullion. In addition, the third party also hedges its own price risk by entering into a forward purchase. Alternatively, the contracted third party “leases” the bullion from another (non-contracted) third party. In either case, the Mint pays a “lease” fee. When the Mint needs the metal, it pays an agreed-upon price, usually the spot price. This payment is actually made AFTER the metal has been fabricated and sold as minted product, thus the “purchase and sale of metals used in these products are completed on the same date, using the same price in the same currency”. An important point is that by storing the bullion with the Mint, the third party insulates the Mint from claims of possession or confiscation, abnormal market conditions and other risks. In addition, the Mint is able to have plenty of inventory on hand without having to pay for it in advance or carry it on the books. Finally, this transaction does NOT result in any other type of obligation (such as a “Gold Debt Obligation” or “Silver Debt Obligation”).

# Can the Mint provide unequivocal assurances that bullion being entrusted to them for storage and safeguarding is not being leased, borrowed or impinged upon in any way?

The “leased” bullion is being stored at the Mint by a contracted third party with the express purpose of having the Mint purchase it at a specified future date. Besides, it would be appropriate only for those actually entrusting the Mint to request such assurances.

# To ease any sense of misappropriation, will the Mint release as soon as possible an inventoried list of all bars currently stored, complete with serial numbers, corresponding refiners and individual ingot weights for all allocated bars entrusted to it for safekeeping (as Barclay’s commodity ETF for silver, SLV, fully revealed, bar by bar, within days of Analyst Ted Butler’s request)

In this case, such a request is not reasonable as it would violate the right to privacy of those storing bullion with the Mint. And despite Ted Butler’s claims that Barclays’ ETF released a bar list based on his request, it was a demand by ACTUAL CUSTOMERS of Barclays that likely prompted them to finally ask the Bank of New York to provide such a bar list despite the fact it was not part of their service agreement. Ted Butler overstates his important–but not unique–contribution.

# What steps has the Mint taken to ensure the legal owners of the bullion being leased are fully aware and have consented to said leasing arrangement?

It would be impossible to carry out the “leasing arrangement” without the knowledge of the “lessor” since there is an actual contractual arrangement signed by both parties not to mention the payment of “lease” fees and the eventual purchase of metal subject to the “lease”.

# And finally, please explain how leasing (by their own admission) rapidly-escalating precious metals is a sound financial policy?

It is sound because metal supply can be disrupted and prices can fluctuate wildly during periods of “rapidly-escalating precious metals”. This is precisely the time you want to have metal available immediately, in your own possession. Otherwise, there could be delays between purchase and delivery to the Mint’s facilities and thus an exposure to price risk.

If we apply similar ratios of gold vs silver leases to the Perth Mint situation the size of the problem is increased exponentially.

For example, the Perth Mint claims to have AUS $715M (about US $622M on 1/1/08) of precious metal leases on page 65 of the 2007 annual report: http://www.perthmint.com.au/about_us_the_perth_mint_annual_reports.aspx

The Perth Mint says most of these leases are to AGR Matthey for inventory purposes BUT AGR Matthey has a “Treasury” function which facilitiates:

Sales and Purchases of precious metal

Location Swaps

Leasing, Consignment Stock and Funding Facilities

Price Hedging

http://www.agrmatthey.com.au/wps/wcm/connect/AGRInternet/agr/treasury/about_treasury/

If we apply the same gold/silver ratios to the Perth Mint as was discovered in the Canadian Mint leasing operations the conclusions are almost 4x as large.

Total $ Leases Silver oz Leased Gold oz Leased

Canadian Mint Total Leased=$224,000,000 Silver oz=2,652,776 (17%) Gold oz=221,636 (83%)

Perth Mint Total Leased=$622,000,000 Silver oz=7,159,106 (17%) Gold oz=619,537 (83%)

Total Leased by both=$846,000,000 total Silver oz=9,811,882 oz Total gold oz=841,173 oz

I wish I had the Kitco leases to add to these but those are under “Super Secret Security” ( as the Mogombo Guru would say….aka “SSS”) by Kitco’s “#1 Man of Mystery”….Mr. Jon Nadler.

Of course, these are very rough estimates and does not provide concrete evidence that any of these leased oz are being used in the suppression operations of the manipulators BUT it does provide better clarity in the very cloudy practice of precious metal leasing.

Now let’s look at WHO may be responsible for the size and scope of the unallocated metal leasing scam….WELL THERE HE IS AGAIN!

Looks like our friend Jon Nadler has talked The Royal Canadian Mint into setting up their own “Unallocated Pooled Accounts” also!

https://online.kitco.com/rcm/introduction.html

Well we know ole’ Jonny boy got his feet wet on gold market manipulation from HSBC and Bank of America before he brought his “Unallocated Pooled Account” program to the Perth Mint, then Kitco, and now The Royal Canadian Mint.

http://www.ibtimes.com/forex/forexperts/biography/jon-nadler.htm

No wonder their gold leasing is going through the roof at the Perth Mint and the Royal Canadian Mint…and likely at the privately held Kitco!

VERY, VERY interesting to note that Mr. Nadler also “consulted on marketing and product development issues” for The US Mint…. NOT THEM TOO!

The insanity never ends!

Bix

Thanks, Tom, for taking the time to set me straight. The reasons why the Mint would engage such a practise are still alluding me, though, so I’m hoping you are still up to clarifying/validating a few points.

T.S.> A third party stores precious metals with the Mint in advance of production requirements.

– Are you saying that on December 31, 2007 the Mint was physically storing 220 thousand ounces of gold and 2.6 million ounces of silver? Wow! That’s a lot of inventory—almost their entire previous year for gold and 70% of 2007’s silver maple production. The Mint really needs that much inventory? (I’m also a bit confused why they would double their gold inventory by the end of 2007 when during that year their gold sales actually *dropped* by 6%.)

T.S.> Because the Mint guarantees these metals will be purchased at a specified future date, the third party is able to borrow funds to acquire the bullion.

– So the Mint pays all costs associated with storing and protecting gold and silver that is physically located on their property and that they will eventually consume but chooses not to own it.

– Instead the Mint helps someone else finance the purchase of the precious metal and until the Mint takes possession it will pay a regular fee to this ‘owner’.

T.S.> When the Mint needs the metal, it pays an agreed-upon price, usually the spot price.

– This scenario makes sense if the metals in question are in a long-term downtrend, but in an obvious uptrend the Mint appears to be getting shafted in every way except being guaranteed supply for product they could probably have financed on their own. Surely, there are easier and cheaper ways to ensure supply (like taking regularly-scheduled deliveries of long contracts on the COMEX)?

T.S.> This payment is actually made AFTER the metal has been fabricated and sold as minted product, thus the “purchase and sale of metals used in these products are completed on the same date, using the same price in the same currency”.

– So the bookkeepers job is easier. Big deal. It sounds like this little convenience is costing the Mint, well “A MINT”. The Annual Report states many times that they believe silver to be in a long-term uptrend—hence the investment in a new refinery dedicated to silver production and the new scrap silver initiatives. By purchasing futures on the COMEX they would (a) pay no lease fees at all, and (b) purchase silver at present-day rates which (based on their stated uptrend belief) should on the whole be significantly lower than the spot rate on the day they eventually take delivery. Isn’t this is how other large commercial commodity consumers ensure regularity of their supply and the original raison d’etre for the futures market? Why the Mint goes for these lease deals instead still baffles me.

T.S.> An important point is that by storing the bullion with the Mint, the third party insulates the Mint from claims of possession or confiscation, abnormal market conditions and other risks.

– And in an uptrend this “third party” pockets a whole lot of money in the process (both in capital gains and rent). I must confess, this whole process sounds really bizarre to me, Tom. Let’s pretend for a moment that you leave a million bucks at my home—it’s yours, but I’ll just keep it for you – I’ll eventually buy it from you, but in the meantime I’ll just hold it for you. I’m the lessee in this scenario and you’re the lessor. Then, oops, it’s gone. (Sorry Tom–No hard feelings?) You’re telling me that I, the lessee, am insulated from any claims of possession or confiscation? I’m the custodian! I’m pretty sure you would be mad as hell at me for losing the money and, maybe, just maybe, you would put a caveat or two in the agreement so that I, the lessee am liable for monies lost while in my care. If you don’t think such caveats are necessary or ‘appropriate’, feel free to drop by with that million anytime, Tom. 😉

T.S.> In addition, the Mint is able to have plenty of inventory on hand without having to pay for it in advance or carry it on the books.

– Without having to pay for it? I thought you said they’re paying lease fees. It sounds like Joe Schmo can go to the Brick, pay no money down and no interest for a year using a mediocre sofa as collateral, but the Royal Canadian Mint’s credit is so bad it can’t cut a similar deal with any bank in the land using (literally) solid gold as security? Amazing.

T.S.> Finally, this transaction does NOT result in any other type of obligation (such as a “Gold Debt Obligation” or “Silver Debt Obligation”).

– Hmmm. Let’s see now. Must store gold. Must protect gold. Must provide commitment to eventually buy gold (I guess the lessor’s credit is good, but the Mint’s isn’t.) Must pay ‘rent’ on gold in the interim. Must pay whatever the future spot rate is for gold. You’re right! Other than those niggly-piggly responsibilities there’s no commitments at all. Heck, they may as well take it out the section of the report they’ve got it in, since it’s called “Commitments and Guarantees”.

It’s the wee hours now, so I’ll address the other points you raise another time. Tom, all kidding aside, I really am grateful for your efforts to shed light on this (IMO) quite complicated topic. Thanks again!

I’m not an all-knowing silver buff but reading all of the dialogue on this topic a few questions come to mind. (If they were answered already, my apologies.)

1. Why would a third party need to be involved in the first place?

2. If the Mint promises to “purchase” bullion at a later date, but tells this third party to hang on to it until they need it, why do they call it a lease if they’re purchasing it?

The definition of a lease is

a contract by which one conveys real estate, equipment, or facilities for a specified term and for a specified rent.

As per the above comments by Tom: “When the Mint needs the metal, it pays an agreed-upon price, usually the spot price.”

Ok, so doesn’t that mean they’ve bought it free and clear? Unless they’re borrowing bullion from this third-party to sell before the Mint gets their own bullion to sell, it doesn’t make much sense to be calling it a lease.

Maybe I’m not really clear on how it all works (since I’m not a silver-buff) but being a fan of silver, I am finding this topic quite interesting.

Thanks Bix, for the info and links to the Perth mint.

Under a section entitled “The Year in Brief” the 2007 Perth Mint Annual Report states: “Coin, medallion and bar sales added value to 4.75 tonnes of gold, 69.82 tonnes of silver and 30 kilograms of platinum.”

At 32150 troy ounces to the tonne that’s 152,712 ounces of gold and 2,244,713 ounces of silver sold in calendar 2007. These number are actually therefore substantially *less* than the Canadian Mint equivalents.

So one must ask the question, why would the Perth Mint lease almost four times *more* silver and gold than the Canadian Mint if the main reason for leasing is mainly to ensure inventory for future production? Using Tom’s rationale above it appears that the Perth Mint has now decided to pay rent for the next *three years* of future production. Wow! Is it really plausible that the Perth Mint likes to be so cautious to the point of paranoia?

I would posit that it is possible that these precious metal leases do not entirely represent actual physical inventory in the current custody of the mint. A quick audit to see if the physical metal is in fact there should put the matter quickly to rest.

In the case of Canada’s mint, according to the telephone conversation slopetester attests to above with David Madge, RCM’s Marketing Director, the lion’s share of silver maples is being sold overseas (80%) — so if these leases do *not* represent physical inventory (that, according to Tom, the Mint has bizarrely opted to leave titled to someone else) then 80% of the physical wealth is being shipped outside the country and Canadian taxpayers are being left on the hook to the tune of tens, potentially hundreds, of millions of dollars.

In light of the Perth mint numbers it appears to be very possible that these leases are, in fact, being rolled over and cumulating and that the physical inventory is for the most part gone, leaving the most toxic of liabilities with both mints: a commitment in the future to supply precious metals that are rapidly rising in price and dwindling in terms of availability.

The more I look into this the crazier it gets.

For those who are new to silver I have one VERY important piece of advise…BUY PHYSICAL IN YOUR POSSESSION ONLY! The dam is about to break and ETF will not survive it. Nor will stocks, certificates or any other fake silver.

How important is the silver issue?

Read this.

Bix

http://www.silverbearcafe.com/private/silvermystery.html

To be the devil’s advocate here (Bix), analysists have been predicting the rise of silver, and shortages of silver, for many years now. And I agree that the arguments are valid ones that make perfect sense. However, I’ve come across articles written in 2003 that could be relevant today. They all predicted we’d see super high silver prices…some say $30/oz…while others have said $200.

Sure we may have already seen what was predicted in ’03 (with us seeing $21/oz.) but I have yet to see $30-$200/oz. like some had predicted back in 2003.

I agree that buying and possessing physical silver is a great investment (and a fun hobby), however I don’t know if I’ll believe what the “bulls” say until it happens.

Yes it may go up…yes it may go down…there’s no way to tell when or by how much, so why even bother with a prediction?

In my eyes, they’re just giving us some hope that it eventually happens. Whether or not it does, that’s another story.

Excellent article on the Royal Canadian Mint. It is nice to see intelligent and independent thought at work for a change.

Well Done!!!

[…] https://dailydose4u.wordpress.com/2008/05/04/why-is-canadas-mint-doubling-its-gold-silver-debts-the-f… […]

If we apply similar ratios of gold vs silver leases to the Perth Mint situation

the size of the problem is increased exponentially.

The Perth Mint and Canadian Mint are apples and oranges. The Perth Mint ‘leases’

precious metals by borrowing it from pool account holders (paying no interest)

and other ‘lessors’ (interest-bearing). The ‘leased’ metal is used in coin

production and lending to its 40% subsidiary AGR Matthey. This metal must

be replaced at a later date. In contrast, the Canadiam Mint takes early

possession of metal under a future purchase commitment (that is what makes it

a ‘lease’). It has no obligation to replace borrowed metal.

T.S. A third party stores precious metals with the Mint in advance of

production requirements.– Are you saying that on December 31, 2007 the

Mint was physically storing 220 thousand ounces of gold and 2.6 million ounces

of silver? Wow! That’s a lot of inventory—almost their entire previous year for

gold and 70% of 2007’s silver maple production. The Mint really needs that much

inventory? (I’m also a bit confused why they would double their gold inventory

by the end of 2007 when during that year their gold sales actually *dropped* by

6%.)

It’s technically not the Mint’s own inventory even though the Mint can and

does dip into it for production. Keep in mind, the Mint produces more than just

gold and silver Maples. In particular, the Mint will produce a substantial run

of collector items for the 2008 Olympics. Also, we are looking at a snapshot

in time so the average ‘lease’ total could very well be lower throughout the

year.

T.S. Because the Mint guarantees these metals will be purchased at a

specified future date, the third party is able to borrow funds to acquire the

bullion.– So the Mint pays all costs associated with storing and

protecting gold and silver that is physically located on their property and that

they will eventually consume but chooses not to own it.- Instead the Mint

helps someone else finance the purchase of the precious metal and until the Mint

takes possession it will pay a regular fee to this ‘owner’.

The choice not to own is based on the desire for operational leverage and

also to avoid exposure to price fluctuations. And yes, the Mint is naturally willing to

pay a fee to achieve this.

T.S. When the Mint needs the metal, it pays an agreed-upon price,

usually the spot price.– This scenario makes sense if the metals in

question are in a long-term downtrend, but in an obvious uptrend the Mint

appears to be getting shafted in every way except being guaranteed supply for

product they could probably have financed on their own. Surely, there are easier

and cheaper ways to ensure supply (like taking regularly-scheduled deliveries of

long contracts on the COMEX)?

Long-term is irrelevant, what matters is short-term price fluctuation between

the time raw material is obtained and finished product is sold. The fact is

that price fluctuations are larger in an uptrend than downtrend and this means

the Mint will actually want to do more and more ‘leasing’ as prices rise.

There is no way the Mint is ‘getting shafted’ given that it pays a negligible

fee to obtain 100% price protection and a guaranteed supply of metal. The problem

with COMEX delivery is that you can’t take a good delivery bar and put it directly

into a coin press to produce Maple Leafs. You will first need to re-melt, re-refine,

fabricate sheets, punch blanks, anneal and burnish (I probably missed

a few steps). Between taking delivery on the COMEX and getting raw blanks ready

for striking, the metal price can move by a lot.

T.S. This payment is actually made AFTER the metal has been fabricated

and sold as minted product, thus the ‘purchase and sale of metals used in these

products are completed on the same date, using the same price in the same

currency’. – So the bookkeepers job is easier. Big deal. It sounds like

this little convenience is costing the Mint, well ‘A MINT’. The Annual Report

states many times that they believe silver to be in a long-term uptrend—hence

the investment in a new refinery dedicated to silver production and the new

scrap silver initiatives. By purchasing futures on the COMEX they would (a) pay

no lease fees at all, and (b) purchase silver at present-day rates which (based

on their stated uptrend belief) should on the whole be significantly lower than

the spot rate on the day they eventually take delivery. Isn’t this is how other

large commercial commodity consumers ensure regularity of their supply and the

original raison d’etre for the futures market? Why the Mint goes for these lease

deals instead still baffles me.

You are grossly overstating the cost and understading the benefits of the

Mint’s ‘leasing’ program. Your ‘super’ idea would result in financial disaster the

first time there is a major correction in the

metal price. Besides, the Mint has no mandate to speculate on rising metal prices. In fact,

‘other large commercial commodity consumers’ have arrangements very similar to, if not exactly like,

the Canadian Mint. The fact you are baffled is a very good indication you should keep

blogging and not apply for a decision-making position at the Mint or any similar

entity where raw material price controls are critical.

T.S. An important point is that by storing the bullion with the Mint,

the third party insulates the Mint from claims of possession or confiscation,

abnormal market conditions and other risks.– And in an uptrend this

‘third party’ pockets a whole lot of money in the process (both in capital gains

and rent). I must confess, this whole process sounds really bizarre to me, Tom.

Let’s pretend for a moment that you leave a million bucks at my home—it’s yours,

but I’ll just keep it for you – I’ll eventually buy it from you, but in the

meantime I’ll just hold it for you. I’m the lessee in this scenario and you’re

the lessor. Then, oops, it’s gone. (Sorry Tom–No hard feelings?) You’re telling

me that I, the lessee, am insulated from any claims of possession or

confiscation? I’m the custodian! I’m pretty sure you would be mad as hell at me

for losing the money and, maybe, just maybe, you would put a caveat or two in

the agreement so that I, the lessee am liable for monies lost while in my care.

If you don’t think such caveats are necessary or ‘appropriate’, feel free to

drop by with that million anytime, Tom.

The third party is likely hedged as well and thus it is speculators

who will get the ‘capital gains’ assuming metal prices rise during the

term of the ‘lease’. Your example of me leaving money at your home is pure hyperbole because

I can deposit that money at a bank and earn interest (are you accusing

me of being the stupidest person on Earth?) This is precisely what the lender

of the ‘leased’ metal is doing by ‘depositing’ bullion with the Mint. As for

‘claims of possession or confiscation’, this is not a concern for the ‘lessor’

since a future sale is contractually guaranteed and the Mint is an ideal counterparty.

Rather, the Mint is the one who should be concerned when metal it has contracted

to receive in the future is not in its own possession, since the ‘lessor’ can

default (including through no fault of its own) and then the Mint will have no metal but

merely a ‘claim’.

T.S. In addition, the Mint is able to have plenty of inventory on hand

without having to pay for it in advance or carry it on the books.–

Without having to pay for it? I thought you said they’re paying lease fees. It

sounds like Joe Schmo can go to the Brick, pay no money down and no interest for

a year using a mediocre sofa as collateral, but the Royal Canadian Mint’s credit

is so bad it can’t cut a similar deal with any bank in the land using

(literally) solid gold as security? Amazing.

Paying a negligible lease fee is a far cry from paying 100% and tying up

capital. Under the ‘lease’ the Mint doesn’t have to pay until it has actually

sold the finished product (because the Mint extends payment terms up to 60 days, it is already financing a portion of its operations). If it were able to borrow money substantially below LIBOR and interest rates were very high, the answer might be different and maybe the “leasing” wouldn’t make sense. But there would still be the issue of buying and selling the metal at a price that GUARANTEES a unit profit. Sorry,

but Joe Schmo cannot get such a deal.

T.S. Finally, this transaction does NOT result in any other type of

obligation (such as a ‘Gold Debt Obligation’ or ‘Silver Debt

Obligation’).– Hmmm. Let’s see now. Must store gold. Must protect gold.

Must provide commitment to eventually buy gold (I guess the lessor’s credit is

good, but the Mint’s isn’t.) Must pay ‘rent’ on gold in the interim. Must pay

whatever the future spot rate is for gold. You’re right! Other than those

niggly-piggly responsibilities there’s no commitments at all. Heck, they may as

well take it out the section of the report they’ve got it in, since it’s called

‘Commitments and Guarantees’.

Congratulations, you have come up with a partial list of the contractual obligations that are

inherent part-and-parcel of the ‘lease’. This does not, however, mean they are ‘debt’

obligations or any other types of obligations other than ‘commitments’ to buy

a given quantity of metal at a future date and a future price, the benefit of which is to protect

the Mint from price fluctuations and supply disruptions. The only reason

these ‘commitments’ are mentioned in the financial statements is that they may

become future liabilities should the Mint not produce sufficient product to

acquire the amount of metal underlying these ‘leases’.

Having said all this, it is possible that under U.S. accounting standards

the Mint’s ‘leases’ would be considered balance sheet obligations if the risks

and rewards of ownership are transferred to the Mint contractually at the

point the Mint takes delivery. Still, this would be only a cosmetic difference

since an offsetting asset would also be required at a corresponding amount.

1. Why would a third party need to be involved in the first place?

2. If the Mint promises to ‘purchase’ bullion at a later date, but tells this

third party to hang on to it until they need it, why do they call it a lease if

they’re purchasing it?

The definition of a lease isa contract by which one conveys real estate,

equipment, or facilities for a specified term and for a specified rent.

As per the above comments by Tom: ‘When the Mint needs the metal, it pays an

agreed-upon price, usually the spot price.’

Ok, so doesn’t that mean they’ve bought it free and clear? Unless they’re

borrowing bullion from this third-party to sell before the Mint gets their own

bullion to sell, it doesn’t make much sense to be calling it a lease.

A third party is required because the Mint cannot accomplish the goal of

protecting against price fluctuations and supply disruptions using a ‘covenant

with God’ or other means. Even if the Mint tried to replicate a ‘lease’

by going directly to forward suppliers, the COMEX, etc. it would technically

be dealing with third parties. The difference is that going at it alone is not

really an option due to the complicated requirements. That is why we have metal

trading desks at bullion banks, love ’em or hate ’em.

You are wrong that the Mint ‘tells this third party to hang on to it until

they need it’. WHY WOULD THE MINT DO THAT??? In fact, the Mint insists

on taking delivery. Because it does so in advance of making payment, the contract

is called a ‘lease’. Whether this meets the traditional definition of ‘lease’

is a matter of semantics that has no bearing on the discussion.

So one must ask the question, why would the Perth Mint lease almost four

times *more* silver and gold than the Canadian Mint if the main reason for

leasing is mainly to ensure inventory for future production? Using Tom’s

rationale above it appears that the Perth Mint has now decided to pay rent for

the next *three years* of future production. Wow! Is it really plausible that

the Perth Mint likes to be so cautious to the point of paranoia?

As I noted above, the Perth Mint is not ‘leasing’ in the same sense as the

Canadian Mint. The Perth Mint borrows metal from pool account holders and through ‘metal

leasing’ in the typical sense, and then delivers most of this metal under

separate ‘metal leases’ to its 40% owned subsidiary AGR Matthey. Only a portion

of the ‘leased’ metal is used in the mint’s own operations. Unlike the Canadian Mint,

the Perth Mint does not appear to be averse to maintaining excess working capital reserves

or having some exposure to price fluctuations (no doubt because AGR Matthey, a company owned in part by private concerns, manages Perth Mint’s hedging programs). In fact, the Perth Mint refers to the

difference between sales and cost of sales as ‘trading profit’! It is perhaps

instructive, then, to observe that it has inferior profits (trading or otherwise) compared to the safety-minded Canadian Mint despite similarly situated operations and a long-term uptrend

in precious metal prices.

I would posit that it is possible that these precious metal leases do not

entirely represent actual physical inventory in the current custody of the mint.

A quick audit to see if the physical metal is in fact there should put the

matter quickly to rest.

None of the amounts noted as ‘precious metal leases’ in the Perth Mint’s

financial statement are ‘actual physical inventory in the current custody of

the mint’ since the disclosures clearly state these precious metals are

held at AGR Matthey under separate ‘leases’.

In the case of Canada’s mint, according to the telephone conversation

slopetester attests to above with David Madge, RCM’s Marketing Director, the

lion’s share of silver maples is being sold overseas (80%) — so if these leases

do *not* represent physical inventory (that, according to Tom, the Mint has

bizarrely opted to leave titled to someone else) then 80% of the physical wealth

is being shipped outside the country and Canadian taxpayers are being left on

the hook to the tune of tens, potentially hundreds, of millions of dollars.

This is all wrong. The Mint is merely in possession of the metal under

‘lease’. Title is irrelevant since it will pass by contract to the Mint and

then immediately to the buyer when the finished product is sold. The Mint never

owned the metal and neither did the Canadian taxpayer, so no wealth is being

shipped out of the country as a result of foreign sales constituting 80% of

Maple production. The proper and sensible way to look at this is that the Mint

is generating income from the mintage of the Maples, but not from price fluctuations.

As such, the Mint is generating income to the account of Canadian taxpapers

rain or shine. If Canadian taxpayers would like their government to engage in

precious metals speculation, I’m sure they can impose their collective will

and make it happen.

In light of the Perth mint numbers it appears to be very possible that these

leases are, in fact, being rolled over and cumulating and that the physical

inventory is for the most part gone, leaving the most toxic of liabilities with

both mints: a commitment in the future to supply precious metals that are

rapidly rising in price and dwindling in terms of availability.

There is no basis to make this conclusion in the case of the Canadian Mint.

It has NO COMMITMENT IN THE FUTURE TO SUPPLY PRECIOUS METALS. At worst, the

Canadian Mint is exposed to a commitment to purchase an excessive

amount of precious metals should its mintage needs fall short. Resulting losses

could be minimized by the immediate sale of excess precious metals or by a direct

hedging program. The Mint may also need to borrow funds from Ottawa on an emergency

basis to pay for the metals as ‘leases’ come due. By contrast, the Perth Mint

does have some risk in its precious metal minting operations, including the

risk of ‘trading’ losses arising from falling precious metal prices.

Yet given that the Perth Mint’s ‘leases’ are ENTIRELY with AGR Matthey,

one of the world’s largest gold refiners, I really doubt ‘the physical inventory

is for the most part gone, leaving the most toxic liabilities’. It is technically

true, nonetheless, that should AGR Matthey go bankrupt for some reason, it may

not be able to return borrowed metal to the Perth Mint, and then presumably

the Government of Western Australia would need to come to the rescue.

Very nice!!